Debt consolidation and bankruptcy are two different ways of managing high amounts of debt. Each can impact your credit (although debt consolidation is usually less damaging). The best option depends on your situation. The bankruptcy system offers some options that can help you get on track. To learn more, here is an overview of debt consolidation vs. bankruptcy.

Debt Consolidation vs. Bankruptcy

Download the Guide HERE

Debt Consolidation

How Does Debt Consolidation Work?

Debt consolidation combines multiple credit card balances into a single loan. You can enroll in a program through a nonprofit credit counseling agency; take out a debt consolidation loan from a bank, credit union, or online lender; or contact your credit card companies directly.

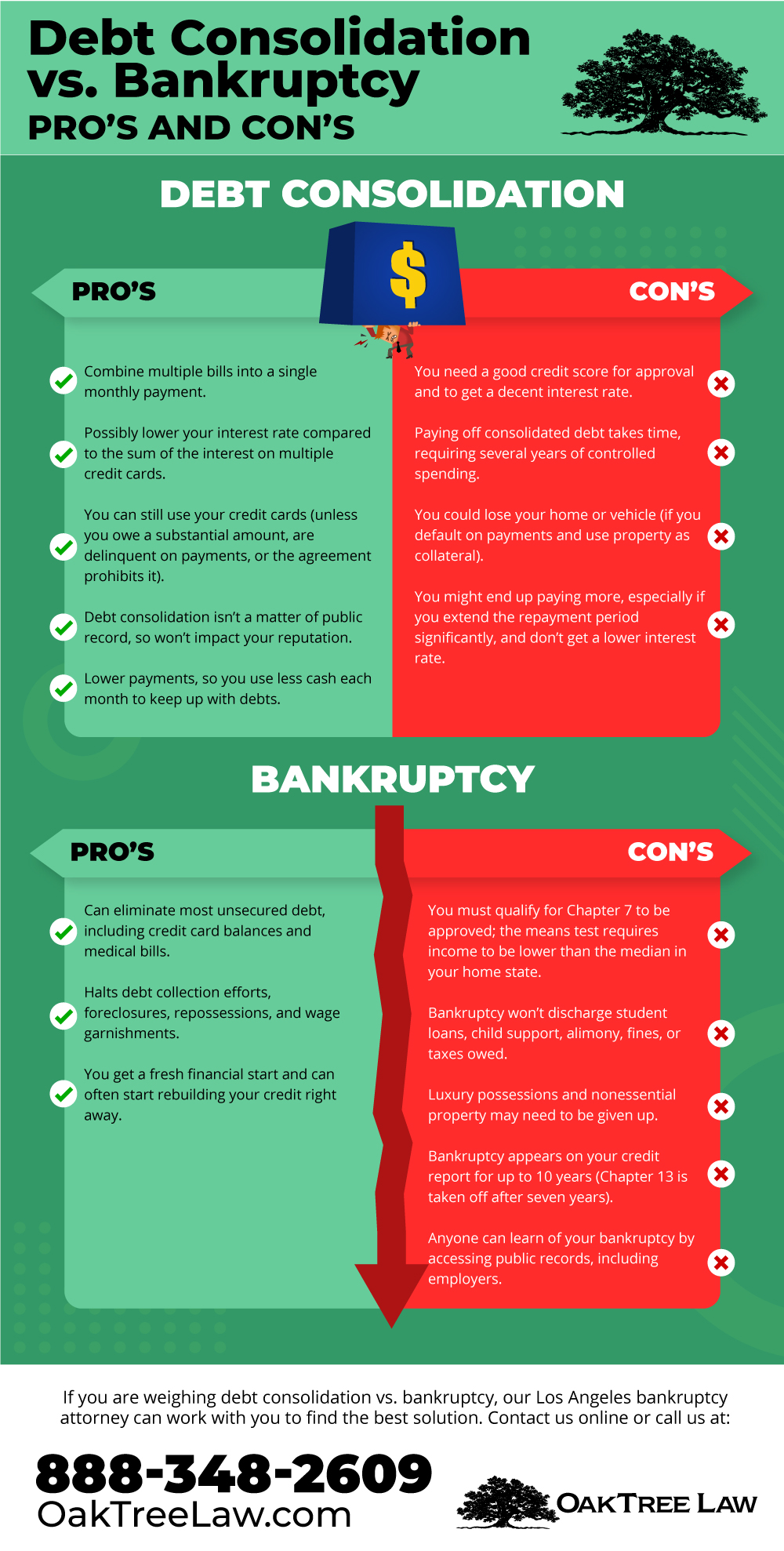

Pros of Debt Consolidation

- Combine multiple bills into a single monthly payment.

- Possibly lower your interest rate compared to the sum of the interest on multiple credit cards.

- You can still use your credit cards (unless you owe a substantial amount, are delinquent on payments, or the agreement prohibits it).

- Debt consolidation isn’t a matter of public record, so won’t impact your reputation.

- Lower payments, so you use less cash each month to keep up with debts.

Cons of Debt Consolidation

- You need a good credit score for approval and to get a decent interest rate.

- Paying off consolidated debt takes time, requiring several years of controlled spending.

- You could lose your home or vehicle (if you default on payments and use property as collateral).

- You might end up paying more, especially if you extend the repayment period significantly, and don’t get a lower interest rate.

How Does Bankruptcy Work?

If you can’t afford to pay what you owe, the federal bankruptcy system provides options to relinquish your obligations to repay debt to creditors. The bankruptcy process is overseen by federal courts. The two main forms of bankruptcy include:

- Chapter 7 Bankruptcy: Provides a discharge of debts, while a trustee takes possession of and liquidates non-exempt property (generally, your home, car, household furnishings, clothes, and other essential items are exempt).

- Chapter 13 Bankruptcy: Involves repaying debt instead of a discharge, and you keep your property. The bankruptcy court and your attorney negotiate a three-to-five-year plan to repay (in some cases, outstanding debt may be discharged after you repaid part of it).

Pros of Bankruptcy

- Can eliminate most unsecured debt, including credit card balances and medical bills.

- Halts debt collection efforts, foreclosures, repossessions, and wage garnishments.

- You get a fresh financial start and can often start rebuilding your credit right away.

Cons of Bankruptcy

- You must qualify for Chapter 7 to be approved; the means test requires income to be lower than the median in your home state.

- Bankruptcy won’t discharge student loans, child support, alimony, fines, or taxes owed.

- Luxury possessions and nonessential property may need to be given up.

- Bankruptcy appears on your credit report for up to 10 years (Chapter 13 is taken off after seven years).

- Anyone can learn of your bankruptcy by accessing public records, including employers.

How Your Credit Score Is Affected

A debt consolidation loan usually has little impact on your credit score, if any, when you stay current on payments. But it does show up on your credit report. If creditors view the loan negatively, it could make it harder to get new credit in the future.

Bankruptcy filings do damage your credit score. The amount of damage depends on your credit score before filing. Generally, your score will drop more if your credit was good before filing than if you had multiple delinquencies and a lower credit score beforehand.

But bankruptcy can help your credit too, by eliminating delinquent accounts and improving your debt-to-credit ratio.

Contact Oak Tree Law

If you are weighing debt consolidation vs. bankruptcy, our Los Angeles bankruptcy attorney can work with you to find the best solution. We have your best interests in mind. If your debt has spiraled out of control, we can help regain control over your financial future. Contact us online or call 888-348-2609 to schedule a free evaluation