Debtors who file for bankruptcy typically don’t have enough money to pay back all their creditors. When someone pays one obligation back over another before filing for bankruptcy, it may be considered a preferential payment. Unfortunately, doing this can complicate your case as there are many rules put in place on this. Your trustee can recover such funds and redistribute them among your unsecured creditors. Here’s a more in-depth look at preferential payments and bankruptcy to help you better plan your path towards financial stability.

Preferential Payments and Bankruptcy Code

The U.S. Bankruptcy Code contains a statute, Section 547 (or preferential-payment rule). It states when a debtor pays a creditor within 90 days of filing, the court can force the creditor to pay that money back so it can be dispersed among other creditors. Selectively paying certain creditors can result in some getting all or most of what’s owed to them while other creditors may receive next to nothing.

There are two main purposes to Section 547. One is to promote fairness and equality regarding the money overseen by the court. The other is to make it more difficult for aggressive creditors to pursue the debtor and file a lawsuit.

How Is a Preferential Payment Defined?

A preferential payment is one made to a single creditor. For payments made within 90 days of a bankruptcy filing, they must meet certain criteria. The debtor’s debts must exceed their assets. The payment must total over $600. In addition, the total must exceed the amount the creditor would have received through the bankruptcy estate.

Also, the debt must have been incurred before the preferential payment was made. Finally, the payment must have been to a “non-insider” creditor. Payments to “insider” creditors, or family members, friends, or business associates, made within one year before filing (not 90 days) can be considered preferential.

How Trustees Get the Money Back

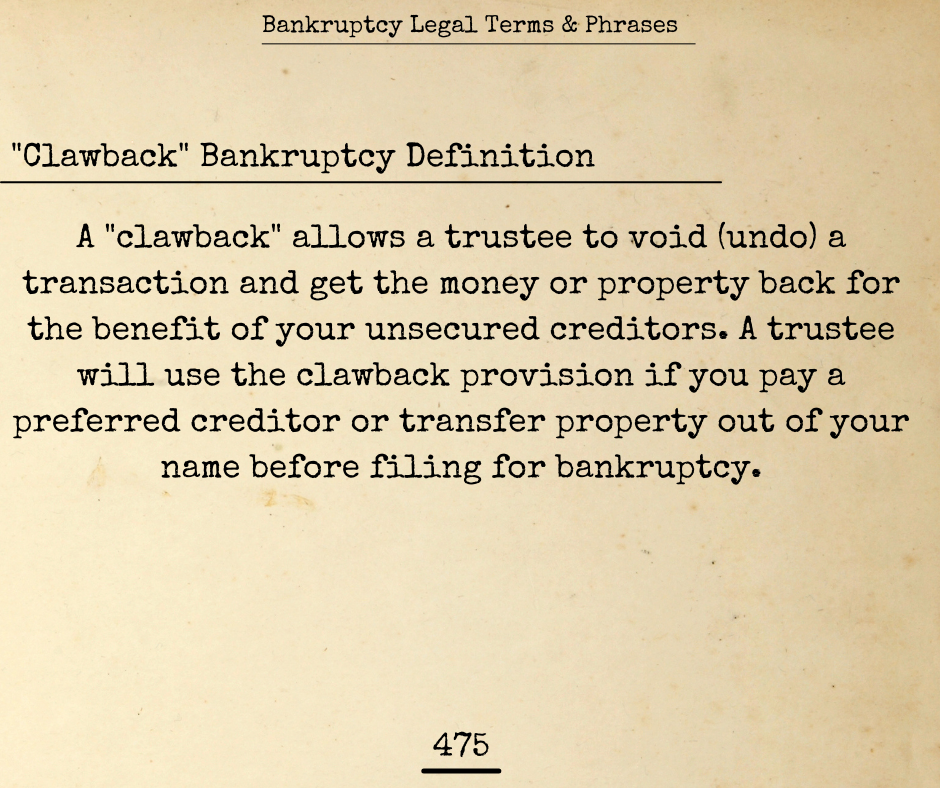

When the court determines a preferential payment was made, the trustee can implement a “clawback” bankruptcy procedure to “avoid” the payment and get the money back. That’s not to say preferential payments are illegal. They’re only so if intended to defraud creditors or hide money. However, the recipient must still return the funds so the trustee can distribute them.

Recovering a preference payment requires the trustee prove all the elements of one are in place. Such a payment is “avoidable” even without a dispute regarding goods sold, services rendered, or intent to make or accept the money. Preference suits are filed in the bankruptcy court and trustees have up to two years after the bankruptcy filing to initiate them.

Defenses: When the Money Can’t Be Paid Back

Preference payment claims are complex. They don’t allow money to be automatically taken. Creditors can raise certain defenses to try and keep the funds sent to them. The “ordinary course of business” defense can apply to payments made as part of a business entity’s financial affairs and were typical in that industry. Another is a “contemporaneous exchange for new value”; the debtor may have paid for something new, and the money in question is not an old debt.

A “subsequent transfer of new value” defense applies when the bankruptcy filer buys something new but pays for it simultaneously. If a preference payment was already made, this can offset or negate the obligation to repay it. Ordinary course of business and contemporaneous exchange defenses usually only apply to non-insider creditors; the trustee can’t take back the money even if all criteria are met.

What to Do If You Made a Preferential Payment

It’s best to not violate the preferential payments/bankruptcy rules. But if you made a preferential payment, there’s not much you can do. The trustee will likely reverse the payment using the clawback procedure. Nonetheless, filing for bankruptcy may still be worthwhile, even if you lose the benefit of having made the payment beforehand.

If you are filing for bankruptcy and believe you made a preferential payment, OakTree Law can help make the next moves and get you back on your financial feet. Our Los Angeles bankruptcy attorney is here to answer all your questions. To schedule a free consultation, call 888-348-2609 today.