Bankruptcy and divorce are both extremely stressful situations. It is even more stressful when both occur at the same time; however, there are many barriers to pursuing both simultaneously. Financial struggles represent the second leading cause of divorce, behind infidelity (per a 2018 study by Ramsey Solutions), and nearly two-thirds of marriages start off in debt.

If bankruptcy is in the cards and you and your spouse are considering divorce, timing is a major factor.

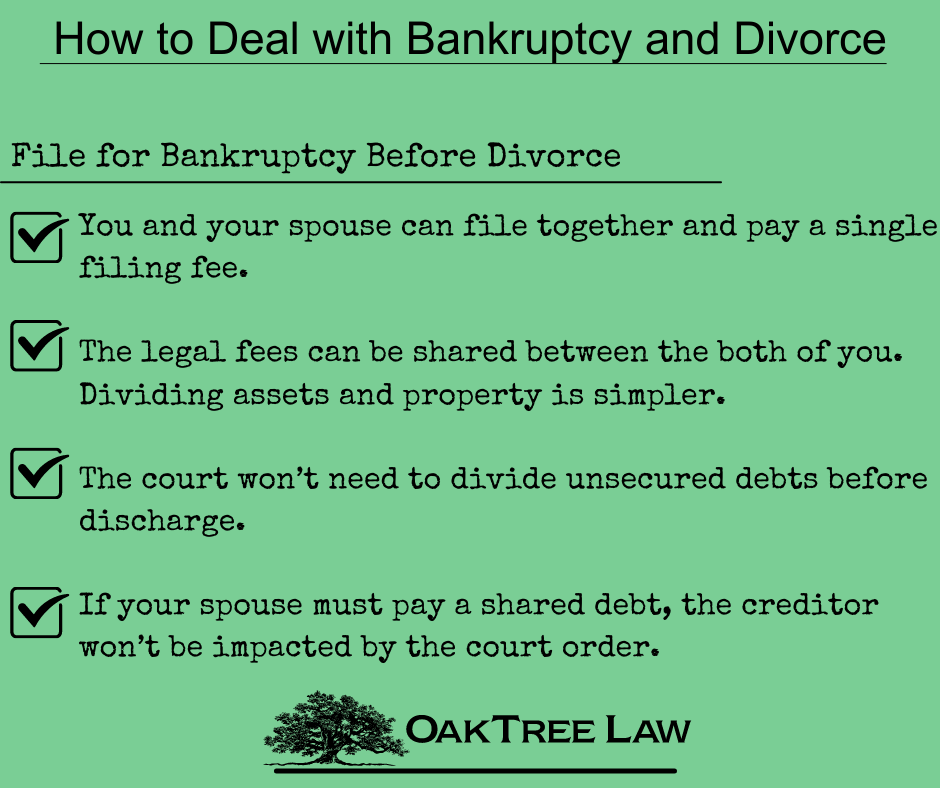

How to Deal with Bankruptcy and Divorce

File for Bankruptcy Before Divorce

If you file for bankruptcy first:

- You and your spouse can file together and pay a single filing fee.

- The legal fees can be shared between the both of you.

- Dividing assets and property is simpler.

- The court won’t need to divide unsecured debts before discharge.

- If your spouse must pay a shared debt, the creditor won’t be impacted by the court order.

When you receive a bankruptcy discharge before filing for divorce, collection activities for that debt must stop, both against you and your spouse. The type of bankruptcy matters too. It is generally better to file for Chapter 7 bankruptcy before divorce, while it may be better to wait to file your bankruptcy case until after a divorce is finalized if you plan to file for Chapter 13. That’s because it would take time to complete a shared repayment plan.

Challenges of Simultaneous Bankruptcy and Divorce

Both cases can interfere with one another. This can potentially result in delays for both your divorce and your bankruptcy case. One reason is that your non-exempt assets will become part of the bankruptcy estate. Assets in your divorce case won’t be divided until your bankruptcy case concludes. The splitting of assets is complicated by the automatic stay on debt collection, so family courts cannot access and divide them. Therefore, a divorce can drag out for longer and create even more emotional stress.

In most instances, a bankruptcy case will be suspended until marital debts and assets are apportioned by the court.

Another challenge is that if the same attorney is representing you and your spouse, and bankruptcy becomes a factor during divorce proceedings, you may need to find new lawyer. Legal professionals are barred from representing clients who have a conflict of interest. And when two parties are seeking divorce, they become opponents from a legal perspective. This adds both time and costs to the equation.

Should I File for Bankruptcy After My Divorce?

If you file for Chapter 13 after the divorce is finalized, you can end up retaining more of your property. Waiting to file can also help if you don’t qualify for Chapter 7 bankruptcy. It’s also a better option if you and your spouse have conflicts of interest. You can then seek a discharge without depending on your spouse’s input.

There are also income qualifications for Chapter 7. If you and your spouse’s income is too high, you may not qualify. After your divorce is final, you may meet the qualifications under the means test if your separate income falls below the threshold. You can then both obtain a discharge of unsecured debts more quickly later.

Contact Oak Tree Law

There are advantages and challenges to filing for bankruptcy before, during, and after divorce. Speak to a Los Angeles bankruptcy attorney at Oak Tree Law to learn about the best options for your situation. Our experienced attorney has the knowledge and compassion to help you navigate the process, avoid the risks, and regain financial control. Schedule your free consultation by calling 888-348-2609 today.